Suppose real estate is the most significant investment a majority of people make in their lifetime. In that case, it’s best to understand the places in Maryland with best potential return on investment.

After working in real estate adjacent roles for over a decade, I had the hypothesis that the best place to buy for a return on investment would be up-and-coming cities. Smaller cities where crime might be high now, but people still move to.

To test my hypothesis, we are going to look at places in Maryland that are growing faster than average, but where home prices are below average, and crime rates are higher than average.

In everyday terms, these might be “deals”. The best deal in Maryland at the moment according to Saturday Night Science? That would be Berlin.

Table Of Contents: Top Ten | Methodology | Summary | Table

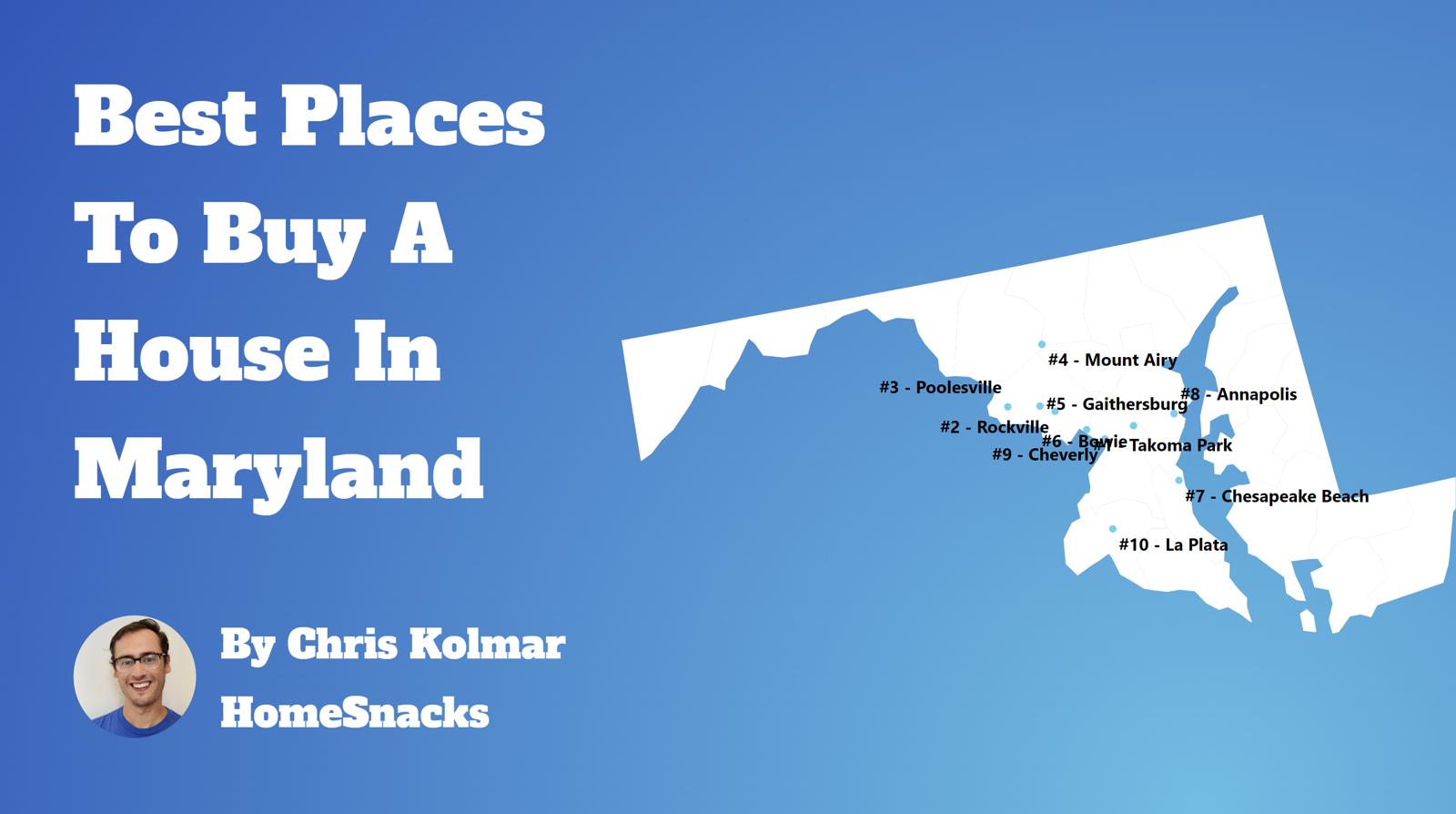

The 10 Best Places To Buy A Home In Maryland For 2024

The methodology that wen’t into this can be a bit complicated, so we’ll break it down for you in as much detail as we can below.

For more Maryland reading:

- Best Counties To Live In Maryland

- Best Places To Raise A Family In Maryland

- Best Places To Retire In Maryland

The 10 Best Cities To Buy A House In Maryland For 2024

/10

/10

/10

Population: 5,522

Median Home Price: $321,064

Population Change: -0.6%

Home Price Change: 3.7%

More on Cheste: Data | Real Estate

/10

Population: 5,686

Median Home Price: $664,155

Population Change: 0.4%

Home Price Change: 2.6%

More on Poolesville: Data | Cost Of Living | Real Estate

/10

Population: 5,603

Median Home Price: $227,517

Population Change: 2.7%

Home Price Change: 6.6%

More on Fruitland: Data | Crime | Cost Of Living | Real Estate

/10

Population: 6,358

Median Home Price: $432,240

Population Change: 0.9%

Home Price Change: 4.0%

More on Chesapeake Beach: Data | Cost Of Living | Real Estate

/10

Population: 5,905

Median Home Price: $327,778

Population Change: -0.4%

Home Price Change: 0.8%

More on District Heights: Data | Crime | Cost Of Living | Real Estate

/10

Population: 6,335

Median Home Price: $412,112

Population Change: -0.1%

Home Price Change: 2.4%

More on Glenarden: Data | Crime | Cost Of Living | Real Estate

/10

Population: 6,239

Median Home Price: $425,026

Population Change: 1.7%

Home Price Change: 6.3%

More on Walkersville: Data | Cost Of Living | Real Estate

/10

Population: 7,781

Median Home Price: $361,416

Population Change: 2.7%

Home Price Change: 4.9%

More on Brunswick: Data | Crime | Cost Of Living | Real Estate

Methodology: How do you determine the best places to buy a home in Maryland for 2024?

We were in real estate for almost five years and have worked on this site for another 9. Suffice it to say we’ve put a lot of thought into finding an excellent place to buy a home.

So all that thinking has come to this moment where we get to spell out how we’d approach finding an up-and-coming place to live in Maryland. Put differently, the analysis will try to find places in Maryland with undervalued homes relative to pent-up demand using Saturday Night Science.

To do that, we looked at the most recent American Community Survey Census data for 2018-2022 and compared it to the previous vintage. Specifically, we used the following criteria:

- Y-o-Y Change In Population (People want to live here)

- Y-o-Y Change In Median Home Prices (People are willing to pay for it)

- Home Prices Relative To The State Average (It’s still kinda cheap)

We want places that are growing, have seen home prices increase in recent years, and are still “cheap” for Maryland with the following caveats:

- Home prices had to be within 20% of the state average (Much lower than that, and you get to some of the more dangerous places)

- Home prices increased in the last year, and

- Above 5,000 people (Bigger cities have more data points)

So of the 0 cities and towns in Maryland, only 43 places made it through our initial filters to even be considered.

We then ranked each place from 1 to 43 for the above criteria, with 1 being the best. We averaged the rankings to create a “best place to buy” index, with the place having the lowest index being the best.

Turns out that Berlin is the best potential gem in the not-so-rough in the Old Line State.

Summary: The Best Places To Purchase A House In Maryland for 2024

There’s our analysis of the best places to buy a house in Maryland. And, to be clear, we aren’t necessarily saying these places are the best places to live, just that it looks like they might be in a couple of years based on the data.

In fact, every place in the following table meets our criteria, so even though it may not look super long, remember we started off with all 0 places in the state.

The best cities to buy a house in Maryland are Berlin, Manchester, Cheste, Poolesville, Fruitland, Chesapeake Beach, District Heights, Glenarden, Walkersville, and Brunswick.

So if we’d could rent or buy in these cities, we’d definitely buy.

For more Maryland reading, check out:

Best Places To Buy A Home In Maryland

| Rank | City | Population | Median Home Price | Population Change | Home Price Increase |

|---|---|---|---|---|---|

| 1 | Berlin | 5,056 | $434,662 | 2.1% | 7.1% |

| 2 | Manchester | 5,403 | $425,271 | 1.0% | 5.2% |

| 3 | Cheste | 5,522 | $321,064 | -0.6% | 3.7% |

| 4 | Poolesville | 5,686 | $664,155 | 0.4% | 2.6% |

| 5 | Fruitland | 5,603 | $227,517 | 2.7% | 6.6% |

| 6 | Chesapeake Beach | 6,358 | $432,240 | 0.9% | 4.0% |

| 7 | District Heights | 5,905 | $327,778 | -0.4% | 0.8% |

| 8 | Glenarden | 6,335 | $412,112 | -0.1% | 2.4% |

| 9 | Walkersville | 6,239 | $425,026 | 1.7% | 6.3% |

| 10 | Brunswick | 7,781 | $361,416 | 2.7% | 4.9% |

| 11 | Hampstead | 6,278 | $397,582 | 0.1% | 5.5% |

| 12 | Cheverly | 6,132 | $468,015 | -1.0% | 1.2% |

| 13 | Thurmont | 6,313 | $355,126 | 1.1% | 6.2% |

| 14 | Taneytown | 7,234 | $362,419 | 0.7% | 5.0% |

| 15 | Ocean City | 6,879 | $449,391 | 0.1% | 4.9% |

| 16 | Riverdale Park | 7,284 | $457,160 | -0.5% | 6.3% |

| 17 | Mount Rainier | 8,262 | $471,063 | -0.3% | -0.5% |

| 18 | Frostburg | 7,118 | $164,894 | -2.3% | 4.0% |

| 19 | Bladensburg | 9,574 | $315,966 | -0.2% | 2.3% |

| 20 | Mount Airy | 9,667 | $575,869 | 0.5% | 3.8% |

| 21 | La Plata | 10,283 | $458,131 | 2.3% | 1.6% |

| 22 | Bel Air | 10,630 | $432,116 | -0.3% | 5.2% |

| 23 | Cambridge | 13,058 | $242,774 | 0.2% | 4.8% |

| 24 | New Carrollton | 13,580 | $385,956 | 0.0% | 1.7% |

| 25 | Havre De Grace | 14,743 | $376,608 | 0.8% | 4.6% |

| 26 | Elkton | 15,830 | $327,018 | 0.7% | 5.1% |

| 27 | Aberdeen | 16,422 | $314,123 | 1.5% | 5.4% |

| 28 | Easton | 17,118 | $415,598 | 1.2% | 3.9% |

| 29 | Takoma Park | 17,542 | $667,796 | -0.4% | 0.7% |

| 30 | Hyattsville | 20,851 | $396,591 | 0.3% | 1.6% |

| 31 | Westminster | 20,099 | $423,805 | 1.6% | 5.1% |

| 32 | Cumberland | 19,041 | $139,025 | 0.1% | 3.0% |

| 33 | Greenbelt | 24,646 | $273,558 | 0.2% | 2.4% |

| 34 | Laurel | 29,581 | $443,952 | 0.5% | 3.2% |

| 35 | College Park | 34,416 | $418,488 | -1.6% | 3.2% |

| 36 | Salisbury | 32,960 | $241,424 | 1.2% | 7.3% |

| 37 | Annapolis | 40,719 | $571,003 | 0.3% | 3.6% |

| 38 | Hagerstown | 43,374 | $260,493 | 0.8% | 6.7% |

| 39 | Bowie | 57,922 | $495,660 | -0.3% | 2.4% |

| 40 | Gaithersburg | 69,016 | $498,395 | 0.3% | 3.3% |

| 41 | Rockville | 67,142 | $606,807 | 0.1% | 3.8% |

| 42 | Frederick | 78,390 | $434,950 | 2.6% | 4.7% |

| 43 | Baltimore | 584,548 | $179,189 | -1.3% | 2.0% |