When you dream of retirement, there are states to consider outside of Florida.

You can dream of North Carolina and sitting on the beaches of the outer banks. Or Colorado, where you can spend years hiking through the Garden of the Gods.

While we can’t help you find your passion, we can help you find the best state to retire to. We used Saturday Night Science to compare data on everything that you would want in a place when you retire. We analyzed criteria like affordable housing, low cost of living, access to amenities, and even the distance to the nearest airport.

While Florida still comes out on top, you can hang up your cleats in states across the Union.

Table Of Contents: Top Ten | Methodology | Summary | Table

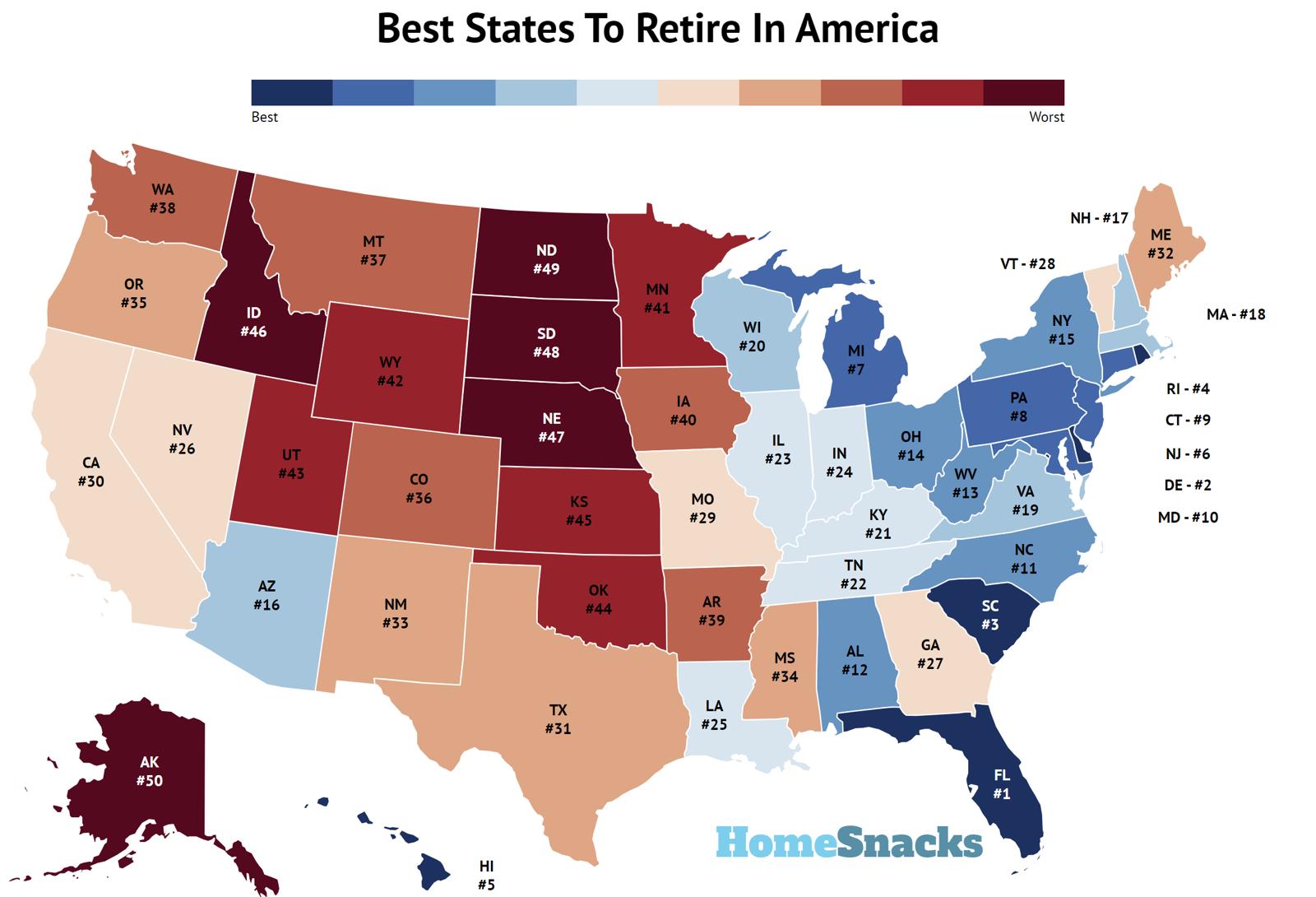

The 10 Best States To Retire In The United States for 2024:

Of course, Florida would come out on top of our ranking because who doesn’t like warm weather, beautiful beaches, Disney, and affordability? Its place as a champion of retirement status is unquestionable.

But there are also great retirement states like Delaware or South Carolina.

What makes these states so great for post-career life? You can live closer to Washington, D.C., without paying the premiums. Or you can sit on your porch, sipping iced tea and reading a good book.

For more reading, check out:

10 Best States To Retire In The United States For 2024

1. Florida

Population: 21,634,529

Rank Last Year: 1 (No Change)

Median Age: 42.4

Median Income: $67,917

Average Home Price: $392,904

More On Florida: Rent

As if you didn’t know, central Florida is the pickleball center of the world, where seniors gather regularly for tournaments. That alone might be enough to entice you into moving to the Sunshine State.

If you’re looking to party with your pickleball peers until you die, you’d be in good company. Florida has the most seniors of all other states, where you’ll find a lot of perfume and mumus.

But the main attraction for retirees to the Sunshine State must surely be the tax situation. Florida has no state income tax, estate tax or inheritance tax, and it doesn’t tax Social Security or other retirement income, either.

And in case you hadn’t heard, Florida’s weather ranks 2nd best in the nation behind Hawaii. But let’s be real – this place is a damn swamp for 6 months a year. So, you’d have to decide, would you rather hide inside all summer down here in Florida, or hide inside all winter in places we talked about earlier like New Hampshire.

Or, if you’re lucky enough to be a snowbird, you have two homes and go back and forth.

2. Delaware

Population: 993,635

Rank Last Year: 2 (No Change)

Median Age: 41.4

Median Income: $79,325

Average Home Price: $373,328

More On Delaware: Rent

This state may come as a surprise for those looking for the best state ever to retire in. Perhaps Delaware isn’t a state you dream about when you are working a long shift at work. Yet, Delaware ranks second in best states to retire and the data supports it.

Delaware ranks 6th in density, 9th in percent of households with kids, and 9.5th for median age. Delaware also has a major perk of being close to Washington, D.C. so you can have a calm weekend or a rocking one out on the town.

3. South Carolina

Population: 5,142,750

Rank Last Year: 3 (No Change)

Median Age: 40.0

Median Income: $63,623

Average Home Price: $287,064

More On South Carolina: Rent

Our first stop? The really pretty state of South Carolina.

Why, you ask, is South Carolina such an amazing place to retire, potentially?

If the mild weather and southern charm of the Palmetto State aren’t enough of a retirement draw, the affordability sure should be. On top of below-average living costs, the tax situation goes easy on a fixed income in South Carolina, where you have low property taxes, and they don’t tax inheritances or Social Security benefits.

In comparison, our worst place to retire is New York, where the cost of living is the 3rd worst in the country, the weather kinda sucks, and it’s not very tax friendly. At all.

4. Rhode Island

Population: 1,094,250

Rank Last Year: 4 (No Change)

Median Age: 40.1

Median Income: $81,370

Average Home Price: $436,519

More On Rhode Island: Rent

The smallest state in the U.S. has a big heart for retirement folks. Rhode Island is a state made for the academically-inclined, those who enjoy sailing, small towns, and colonial architecture. It’s also close enough for weekend trips to New York City or Boston so you can have the nightlife without living in it.

Rhode Island ranks 2nd in density, has low crime rates, and is a family-friendly state.

5. Hawaii

Population: 1,450,589

Rank Last Year: 6 (Up 1)

Median Age: 39.9

Median Income: $94,814

Average Home Price: $830,193

More On Hawaii: Rent

Of course, Hawaii’s a great place to retire. If you can afford it. Cause this state has a lot to do to keep a 65 and a half year old entertained for the rest of his or her lifetime.

But the cost of living is just a joke. Hawaii is by far the most expensive state to live in, with an 87% above the US average cost of living.

However, taxes are below average and health care costs are surprisingly affordable at 12% below the national average. The hospitals here are great, seniors here are very active, there’s a large amount of community activities.

And you KNOW there’s pickleball courts everywhere. But we have to imagine it since we couldn’t visit.

The average cost a year to retire in Hawaii is $65,432 a year.

6. New Jersey

Population: 9,249,063

Rank Last Year: 5 (Down 1)

Median Age: 40.0

Median Income: $97,126

Average Home Price: $495,846

More On New Jersey: Rent

Going up north for number 8 on our list. New Jersey is a state that many people feel are inferior to its neighbor, New York. However, New Jersey has its own perks. Like affordability. In New Jersey, you can eat Hershey’s chocolates all you want fresh from the factory. You can also visit New York City without spending an arm and a leg on rent that will drain your pension and ending your retirement early.

New Jersey has low crime and is filled with people for you to socialize with that are outside of the office life.

7. Michigan

Population: 10,057,921

Rank Last Year: 7 (No Change)

Median Age: 39.9

Median Income: $68,505

Average Home Price: $233,858

More On Michigan: Rent

8. Pennsylvania

Population: 12,989,208

Rank Last Year: 8 (No Change)

Median Age: 40.8

Median Income: $73,170

Average Home Price: $256,703

More On Pennsylvania: Rent

9. Connecticut

Population: 3,611,317

Rank Last Year: 9 (No Change)

Median Age: 40.9

Median Income: $90,213

Average Home Price: $381,629

More On Connecticut: Rent

10. Maryland

Population: 6,161,707

Rank Last Year: 10 (No Change)

Median Age: 39.1

Median Income: $98,461

Average Home Price: $404,251

More On Maryland: Rent

Maryland is a state known for its proximity to Washington, D.C. You can reap the affordability of Maryland and use those savings for nights out in D.C. But Maryland has its own great cities to explore as well. Baltimore is a bustling city ready for adventure–just look up its famous boardwalk.

Maryland has high density, meaning you can find loads of people who share your hobbies and interests. And if you want to spend your retirement helping with local universities, Maryland has one of the highest colleges per capita ranks in the country.

How We Determined The Best States To Retire In The US For 2024

To create our list of the best states in America to retire, we used Saturday Night Science to compare the most recent American Community Survey Data from the Census combined with data on colleges from the CollegeScorecard to get our universe of data. For each state, excluding DC, we looked at the following criteria:

- Colleges per capita

- Density (Things to do)

- Latitude (The further south, the better)

- Median age (higher is better)

- Households with kids(lower is better)

We then ranked each state on each criterion from one to 50, with the lowest number being the best.

Finally, we took the average rank across these criteria. The state, in this case Florida, with the lowest average rank, was crowned the best of the state to retire — a place for you to start your second career. We updated this article for {year}. This article is our { annual } time ranking the best states to { category } in America.

It confirmed the obvious, which gave us faith in the data.

Hanging Up The Cleats On The Best States To Retire In America For 2024

So where do you envision yourself? Are you a New Yorker searching for a calmer place than Manhattan, but not willing to move too far away? Perhaps Rhode Island is your retirement state of choice. If you are looking for a quiet nook to write a book or fish for hours a day, maybe you should think about the South.

No matter where you choose, you can be sure that any state on this ranking will give you an exciting place to spend your retirement. Whether you are a city-dweller or country farmer, there is a state perfect for you.

Motivated to work towards your dream retirement? Hopefully, the weeks will be easier knowing that there are states for everyone that can be affordable and fun.

The best states to retire in the United States are Florida, Delaware, South Carolina, Rhode Island, Hawaii, New Jersey, Michigan, Pennsylvania, Connecticut, and Maryland.

Here’s a quick look at the bottom of the list of the best states to retire:

- Alaska

- North Dakota

- South Dakota

For more reading, check out:

Detailed List Of The Best States To Retire In The US For 2024

| Rank | State | Average Income | Average Home Price | Median Age | Household With Kids |

|---|---|---|---|---|---|

| 1 | Florida | $67,917 | $392,904 | 42.4 | 26.7% |

| 2 | Delaware | $79,325 | $373,328 | 41.4 | 27.4% |

| 3 | South Carolina | $63,623 | $287,064 | 40.0 | 28.7% |

| 4 | Rhode Island | $81,370 | $436,519 | 40.1 | 27.3% |

| 5 | Hawaii | $94,814 | $830,193 | 39.9 | 30.7% |

| 6 | New Jersey | $97,126 | $495,846 | 40.0 | 31.6% |

| 7 | Michigan | $68,505 | $233,858 | 39.9 | 27.7% |

| 8 | Pennsylvania | $73,170 | $256,703 | 40.8 | 27.5% |

| 9 | Connecticut | $90,213 | $381,629 | 40.9 | 29.1% |

| 10 | Maryland | $98,461 | $404,251 | 39.1 | 31.2% |

| 11 | North Carolina | $66,186 | $320,323 | 39.1 | 29.7% |

| 12 | Alabama | $59,609 | $221,926 | 39.3 | 29.3% |

| 13 | West Virginia | $55,217 | $157,498 | 42.6 | 26.0% |

| 14 | Ohio | $66,990 | $218,216 | 39.6 | 28.5% |

| 15 | New York | $81,386 | $452,476 | 39.3 | 28.3% |

| 16 | Arizona | $72,581 | $423,568 | 38.4 | 30.1% |

| 17 | New Hampshire | $90,845 | $448,250 | 43.1 | 26.6% |

| 18 | Massachusetts | $96,505 | $589,253 | 39.8 | 28.4% |

| 19 | Virginia | $87,249 | $371,544 | 38.7 | 30.7% |

| 20 | Wisconsin | $72,458 | $286,891 | 39.9 | 26.9% |

| 21 | Kentucky | $60,183 | $197,457 | 39.1 | 30.3% |

| 22 | Tennessee | $64,035 | $309,795 | 38.9 | 29.8% |

| 23 | Illinois | $78,433 | $252,041 | 38.7 | 29.5% |

| 24 | Indiana | $67,173 | $230,053 | 38.0 | 30.2% |

| 25 | Louisiana | $57,852 | $199,312 | 37.6 | 30.7% |

| 26 | Nevada | $71,646 | $418,963 | 38.5 | 30.1% |

| 27 | Georgia | $71,355 | $319,165 | 37.2 | 32.4% |

| 28 | Vermont | $74,014 | $384,154 | 42.9 | 24.1% |

| 29 | Missouri | $65,920 | $237,658 | 38.8 | 28.8% |

| 30 | California | $91,905 | $746,472 | 37.3 | 33.3% |

| 31 | Texas | $73,035 | $298,423 | 35.2 | 35.6% |

| 32 | Maine | $68,251 | $386,587 | 44.8 | 24.2% |

| 33 | New Mexico | $58,722 | $293,040 | 38.6 | 28.6% |

| 34 | Mississippi | $52,985 | $174,931 | 38.1 | 31.7% |

| 35 | Oregon | $76,632 | $487,750 | 39.9 | 27.7% |

| 36 | Colorado | $87,598 | $531,605 | 37.3 | 29.4% |

| 37 | Montana | $66,341 | $447,821 | 40.1 | 26.1% |

| 38 | Washington | $90,325 | $568,346 | 38.0 | 30.0% |

| 39 | Arkansas | $56,335 | $199,259 | 38.4 | 31.0% |

| 40 | Iowa | $70,571 | $210,484 | 38.4 | 28.9% |

| 41 | Minnesota | $84,313 | $324,667 | 38.5 | 29.4% |

| 42 | Wyoming | $72,495 | $338,887 | 38.5 | 28.9% |

| 43 | Utah | $86,833 | $510,835 | 31.4 | 39.2% |

| 44 | Oklahoma | $61,364 | $198,107 | 36.9 | 31.8% |

| 45 | Kansas | $69,747 | $216,853 | 37.1 | 30.5% |

| 46 | Idaho | $70,214 | $442,087 | 36.9 | 32.2% |

| 47 | Nebraska | $71,722 | $249,973 | 36.9 | 30.7% |

| 48 | South Dakota | $69,457 | $293,181 | 37.5 | 29.4% |

| 49 | North Dakota | $73,959 | $251,027 | 35.4 | 27.8% |

| 50 | Alaska | $86,370 | $349,554 | 35.3 | 32.7% |

Retire Places By State

Best Places To Retire In Alaska

Best Places To Retire In Alabama

Best Places To Retire In Arkansas

Best Places To Retire In Arizona

Best Places To Retire In California

Best Places To Retire In Colorado

Best Places To Retire In Connecticut

Best Places To Retire In Delaware

Best Places To Retire In Florida

Best Places To Retire In Georgia

Best Places To Retire In Idaho

Best Places To Retire In Illinois

Best Places To Retire In Indiana

Best Places To Retire In Kansas

Best Places To Retire In Massachusetts

Best Places To Retire In Maryland

Best Places To Retire In Maine

Best Places To Retire In Michigan

Best Places To Retire In Minnesota

Best Places To Retire In Missouri

Best Places To Retire In Mississippi

Best Places To Retire In Montana

Best Places To Retire In North Carolina

Best Places To Retire In North Dakota

Best Places To Retire In Nebraska

Best Places To Retire In New Hampshire

Best Places To Retire In New Jersey

Best Places To Retire In New Mexico

Best Places To Retire In Nevada

Best Places To Retire In Oklahoma

Best Places To Retire In Oregon

Best Places To Retire In Pennsylvania

Best Places To Retire In Rhode Island

Best Places To Retire In South Carolina

Best Places To Retire In South Dakota

Best Places To Retire In Tennessee

Best Places To Retire In Texas

Best Places To Retire In Virginia

Best Places To Retire In Vermont

Best Places To Retire In Washington

Best Places To Retire In Wisconsin